|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Jumbo Loan 10 Down Payment: A Comprehensive GuideWhat is a Jumbo Loan?A jumbo loan is a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are often used to purchase luxury homes in high-cost areas and cannot be purchased or guaranteed by Fannie Mae or Freddie Mac. The Concept of 10% Down PaymentTraditionally, jumbo loans require a 20% down payment due to the higher risk to lenders. However, many lenders now offer jumbo loans with a 10% down payment option, making it more accessible to borrowers. Benefits of 10% Down Payment

ConsiderationsWhile a 10% down payment may seem attractive, it's important to consider some factors:

Eligibility CriteriaLenders have stringent requirements for borrowers seeking a jumbo loan with a 10% down payment. These typically include:

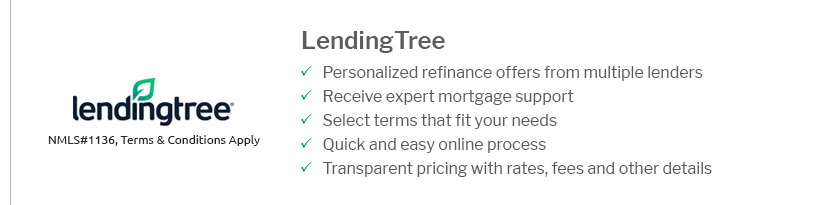

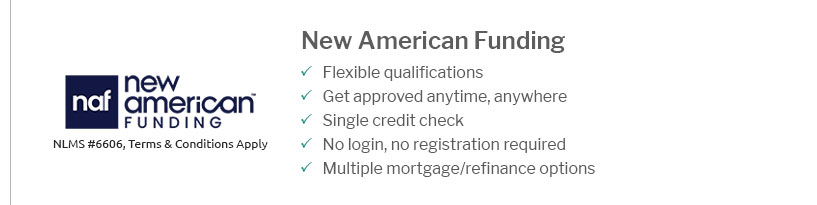

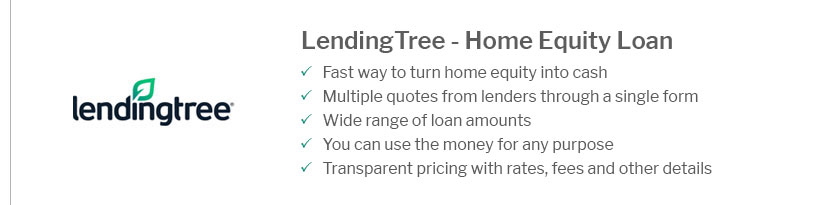

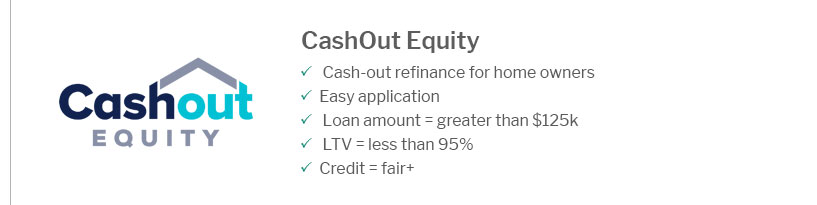

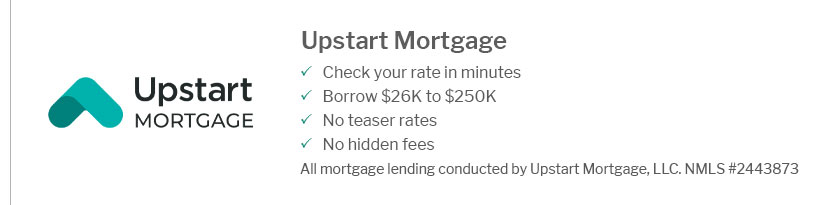

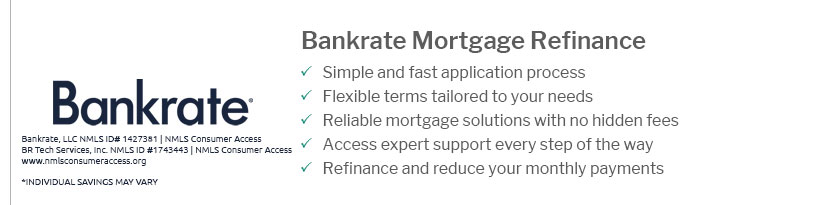

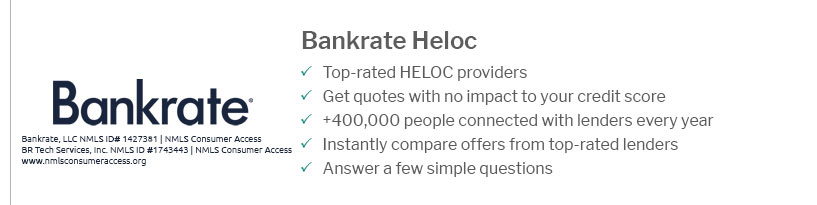

Exploring the Application ProcessThe process of applying for a jumbo loan with a 10% down payment is similar to other mortgages, but with more stringent underwriting criteria: Documentation RequiredApplicants need to provide extensive documentation to prove their financial stability and creditworthiness. This includes tax returns, bank statements, and employment verification. Working with LendersFinding the right lender is crucial. It is advisable to compare offers and terms from multiple lenders. Consider consulting a real estate refinance expert for better guidance. FAQWhat are the risks associated with a jumbo loan 10 down?The primary risks include higher interest rates, the need for PMI, and the potential for financial strain if the borrower's income is not stable. It's important to assess your financial situation carefully before proceeding. How can I improve my chances of approval for a jumbo loan?Improving your credit score, maintaining a low debt-to-income ratio, and ensuring a stable income can enhance your chances. Providing a larger down payment than the minimum required can also be beneficial. Is a jumbo loan 10 down right for me?It depends on your financial situation, risk tolerance, and future plans. Consulting with financial advisors and considering your long-term goals is essential to make an informed decision. https://www.cnbc.com/select/jumbo-loan-the-best-lenders-to-consider/

Our methodology - Rocket Mortgage: Best for customer service - Chase Bank: Best for larger jumbo loans - PNC Bank: Best for low rates - Flagstar: ... https://www.uhloans.com/loan-options/10-percent-down-jumbo-loan/

Well-qualified buyers can obtain a Jumbo Loan with as little as 5% or 10% down, allowing them to expand their budget and find their dream home. https://www.sofi.com/home-loans/jumbo-mortgage-loans/

Low down payment. Put as little as 10% down on a jumbo mortgage loan. Dedicated Mortgage ...

|

|---|